Table of Contents

The tax is charged at checkout and depends on the customer's location. It's up to you to check which tax rate applies for which location. The tax locations should fit with your Shipping zones, e.g. if you ship to Sweden, France and Germany, you will set Tax locations for Sweden, France and Germany.

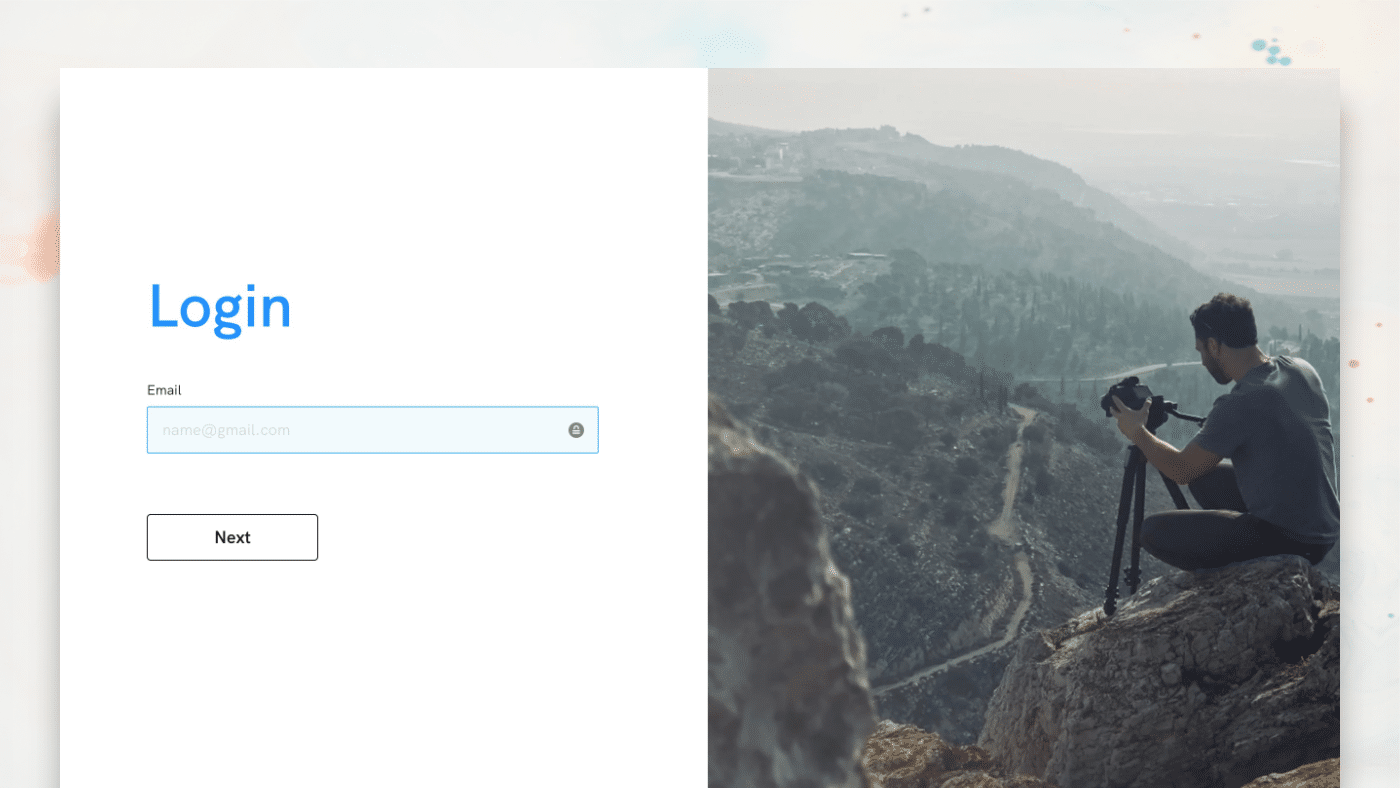

Open the Store Settings

To create tax locations, you first need to open the store settings:

- Click Settings at the top right corner of the admin panel.

- Click E-Commerce Settings.

- On the left side of the dialogue window, select Taxes.

Choose a tax method

Manually Handled Tax

Choose the tax method Manually Handle Taxes.

Taxes are not added on checkout. After you have received an order you will have to manually calculate the taxes and send the customer an updated receipt.

Automatically Charged Taxes

You can now set up your tax locations:

- Choose the tax method Charge Tax at Checkout based on Customer Location.

- Click on Add New Tax Location.

- Choose a country in the list.

- Set a Tax rate in percentage.

Tax Everywhere Else

NB! When you set your first tax location, a second location called Everywhere Else is created at the same time. You can choose to disable this zone if you only want to ship to locations you specify.